[ad_1]

When you inherit a property from your mothers and fathers or family, there are some points you have to have to sort out and inquiries to solution. Is it improved to offer the inherited house or maintain it? What if the residence was left for you jointly with your sibling? Does the house continue to have a mortgage on it? What legal problems do you have to offer with? Points like inheritance tax, stamp duty, and funds gains tax. Luckily you can market your dwelling for free.

What Happens Soon after Inheriting A Home?

In advance of moving in or advertising on and benefiting from the commence, there are some authorized processes that have to be done 1st. This is a swift summary of the course of action.

Locate The Will

The first move you have to do when working with inherited residence is to create your authorized marriage with it. Was there a will left by the deceased? Are you the beneficiary of the will (this means you have the suitable to get a share of the estate)? Are you an executor? (You are the man or woman to sort out the estate of the deceased). If the deceased didn’t go away a will, the subsequent of kin implement for a ‘grant of administration’ which reveals the legal rights to offer with the deceased’ estate. If there is not any will, the regulation is likely to figure out who inherits what.

Going Through Probate

This is the authorized system exactly where executors of the will execute the affairs of the deceased. This will involve accumulating and evaluating belongings – house and funds owed by the deceased – and clearing any superb expenditures or taxes just before distributing the remaining. This course of action can be time-consuming and can get up to a calendar year to complete – which implies you have time to figure out what you are heading to do with what you get.

The House loan Status

The home inherited is only going to be yours following the probate system is carried out. You just can’t do significantly right up until then. It is significant to test if the residence had a house loan and then get in contact with the loan provider and enable them know the latest condition. There are loan providers who are going to give a grace time period the place they suspend repayments as the estate is getting sorted out. The moment you are the legal owner, and the home finance loan wants to be paid, you are the 1 heading to do that.

Transfer Of Possession

When the probate method is performed and the will is administered, you are going to get the property ownership. You ought to go to the Land Registry to sign-up your ownership. This is not a have to unless of course you are dealing with a mortgaged or bought home, but it can be a excellent evidence of ownership and helps make points a little much easier when working with the home in the future. Consider tips from your financial advisor and solicitor to make the very best use of the inheritance.

What is going to occur if the inheritance arrives with a house loan?

If you are in the British isles and you inherit a residence that has a house loan, the duty gets to be yours and you have to make the repayments. You have to do this even if you are not living in the property. There are scenarios in which the deceased has a existence insurance plan plan, which can help in spending off the mortgage loan if there is no policy or it is not adequate to fully include the house loan, you will be faced with two options as soon as you have the house in your possession.

Advertising the home and then working with the money to shell out off the remaining total in home finance loan

Choose out a new property finance loan on the assets utilizing your title.

What about inheriting a share of a household?

If you inherit a property with other functions, then it indicates each a person of you has an equal share in the home, except if or else mentioned. You are the types likely to make your mind up how to divide the property amongst by yourself. There are two styles of joint possession in legislation:

Joint Tenants

All people has equal rights and the house is break up equally between the beneficiaries. If one particular of the beneficiaries dies, the residence is heading to stay with the other people. The last person can then move the assets to a beneficiary they decide on.

Tenants In Popular

This is in which diverse people today have house but they don’t have the identical percentage of possession. The beneficiaries can opt for to move their share to an individual else if they want to, which gives them a minimal more flexibility.

There are situations when it is quick to just provide the house. When the property is offered, the proceeds can be effortlessly divided concerning the beneficiaries.

What If You Are Intrigued In Retaining That Assets?

As soon as possession has been transferred, and there is a mortgage loan on the property that you need to have to set in your identify, then you can do it – irrespective of whether with a new house loan arrangement or the exact same financial institution. You have to move credit score checks and affordability checks possibly way. If there is no will need for a home loan, you can go into the house and start out dwelling inside it appropriate away.

What If You Want To Market The Home?

It can be a minimal complicated to offer an inherited home – especially when you need to update it or if it’s a lengthy way from exactly where you dwell. Remove the contents of the house – you can offer the things or donate them to charity outlets. You can employ the service of a skilled residence clearance if you want the very best benefits.

If the household had elderly house owners, then it may be a fantastic thought to get the job done on the décor and carpets so they can be eye-catching to prospective potential buyers. This will let you get the most effective achievable cost. Talk to the area genuine estate agents and uncover out its well worth and what you can do to increase the worth. As soon as you set it up for sale, it is just the exact thing as providing any other dwelling, while you may have to component in capital gains tax and inheritance tax.

Is Stamp Duty Compensated On An Inherited Residence?

Stamp duty land tax is paid following buying a assets or land in the British isles. If you have been given the property by means of a will, you do not have to fork out for it. You will just have to pay back for inheritance tax.

How A lot Funds Gains Tax Is Going To Be Charged On An Inherited Assets?

Cash gains tax is likely to be utilized when marketing the inherited residence if it is not your most important home. The quantity you need to shell out is going to rely on the cash or taxable gains from the sale and private profits. HMRC is going to increase the profit acquired by advertising the property to your money and see which Profits Tax band you are likely to be in that year. You will then have to spend money gains tax on taxable income using the distinct level used for your tax band. Equally your economical adviser and solicitor are likely to suggest you on what to do.

When Does A Individual Pay out Inheritance Tax?

You really don’t have to right pay the inheritance tax as the inheritor mainly because it is going to be paid employing money from the deceased’s estate. If you are a beneficiary, you can choose to elevate resources or use your personal savings to fork out the inheritance tax so you really don’t have to provide equity in the home.

It is difficult when it arrives to who demands to shell out, which makes it a excellent concept to speak to a economic adviser.

If an estate is value significantly less than £325,000, you don’t have to spend any tax. If it is well worth far more than that, you have to have to spend tax on what is higher than that total.

The tax threshold can go up to £450,000 if the deceased owned their household or share in it, but this applies when the property has been remaining for youngsters and grandchildren – this features foster, adopted, ad stepchildren – and the complete value of the estate is not far more than £2 million.

The regular inheritance tax charge is 40% in the United kingdom and it is payable primarily based on the estate benefit – which includes expenditure, properties, and other assets. The inheritance tax need to be compensated to HMRC by the close of the sixth month after the dying of the individual. If the particular person handed absent in April, it has to be compensated by 30 October the same calendar year.

What If The Inherited House Is In A Rely on?

A have faith in is a way to maintain and handle money or house for those people who may possibly not be equipped to do it them selves. If you have been remaining with a property and it is in a have confidence in, you are heading to be referred to as the beneficiary. The trustee is the legal proprietor of the home and they are the kinds tasked with working with the property as established out in the will by the deceased.

What Occurs If The Inherited Assets Is Abroad?

When the operator of the property passes absent, all their international property which include things like lender accounts, overseas house, and investments. These are heading to be added to the estate, which is then liable to the country’s inheritance tax. There are cases wherever you have to aspect in taxes in the region where the assets is located in. There are numerous nations throughout the world that have double taxation treaties with the United kingdom. This is essential for the reason that it indicates you can assert back any double payments you have manufactured.

What Occurs To An Inherited Home If There Is A Divorce?

When it arrives to divorce in England and Wales, all the assets are pooled together and then they become joint property. House or income that you have been given as inheritance is not likely to be excluded mechanically from the belongings to be divided. Each individual scenario is not the identical and there are a ton of elements that are heading to be considered in the course of the process, which includes inheritance, when you received it, how you dealt with it during the marriage, and the monetary desires of each parties.

[ad_2]

Supply link

More Stories

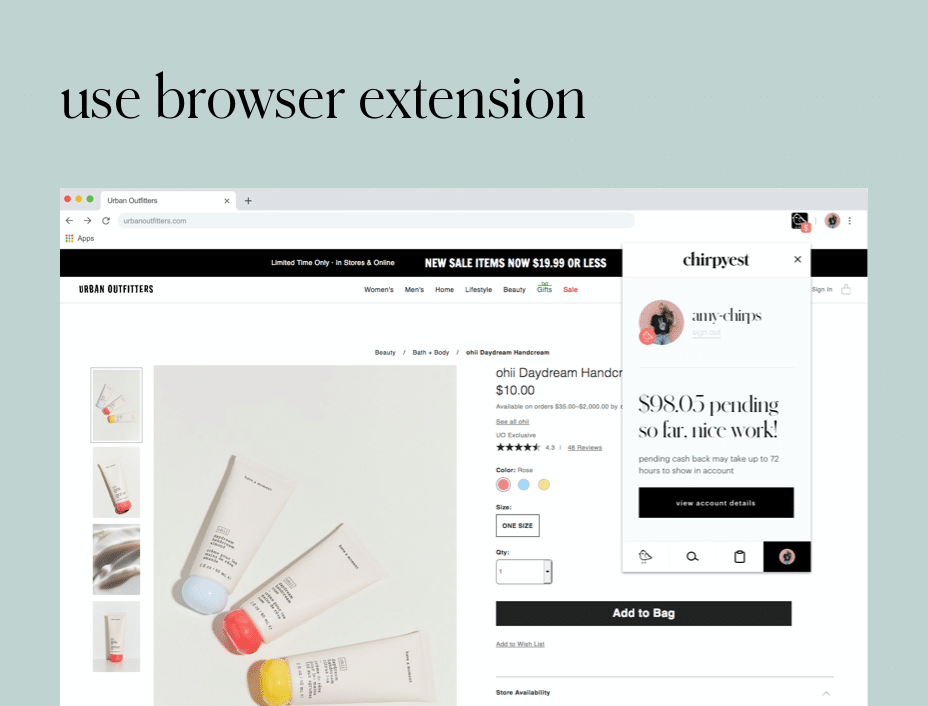

Shop Smart for the Holidays with the Chirpyest Browser Extension

The Courtyard Residence by FGR Architects

Driftaway – SA Decor & Design